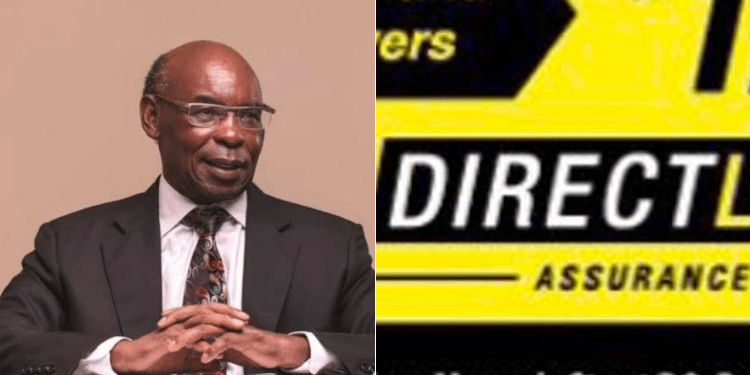

Directline Assurance has terminated its issuance of insurance business with immediate effect.

The company says any further transactions must be made through its original shareholders and has termed a CR12 purporting to have other shareholders as fake and obtained through the backdoor.

According to Directline, it has decided to close its insurance operations and noted that the shareholders of the company have resolved to cease issuing insurance policies and to stop conducting insurance business effective September 10, 2024.

The termination further states that the Association of Kenya Insurance Companies (AKI) is instructed not to issue any insurance certificates or stickers in the name of Directline Assurance Company Limited from the said date.

The notice further reads, in part; “The company is no longer under the regulation of the Insurance Regulatory Authority as per the Insurance Act Cap 487. Subsequently, all banks dealing with Directline Assurance Company Limited are notified that the CR12 currently in circulation is fraudulent and does not reflect the true shareholding or directorship of the company.”

“They are prohibited from making any transactions not authorized by the real shareholders, who are Royal Credit Limited, S.K. Macharia, and Mrs Macharia.”

Directline accuses IRA saying it has permitted and continues to permit the issuance of the fraudulent CR12 despite being fully aware of the fraud dating back to 2005.

The fraudulent CR12 has been used to mislead the courts into making rulings that are prejudicial to the real shareholders of the company.

Directline says the persons or entities listed in the fraudulent CR12 are neither shareholders nor directors of the company.

“They are liable for the employees they employed in the name of the company and also liable for the monies and assets worth over Sh7 billion (out of which Sh2.3 billion was paid to Actis, a UK-based company), which they took from the company contrary to Section 71 of the Insurance Act,” read the notice.